Co-op and condo communities come in all shapes, sizes, and configurations. They range from three-unit, wood-frame houses to high-rise apartment buildings containing hundreds of units, to sprawling townhouse communities in park-like settings. Like these communities, firms specializing in their management and operation can be large or small, generalist or boutique. The question for boards, shareholders, and owners is, what type of firm is right for you and your community?

Big vs. Small, General vs. Boutique

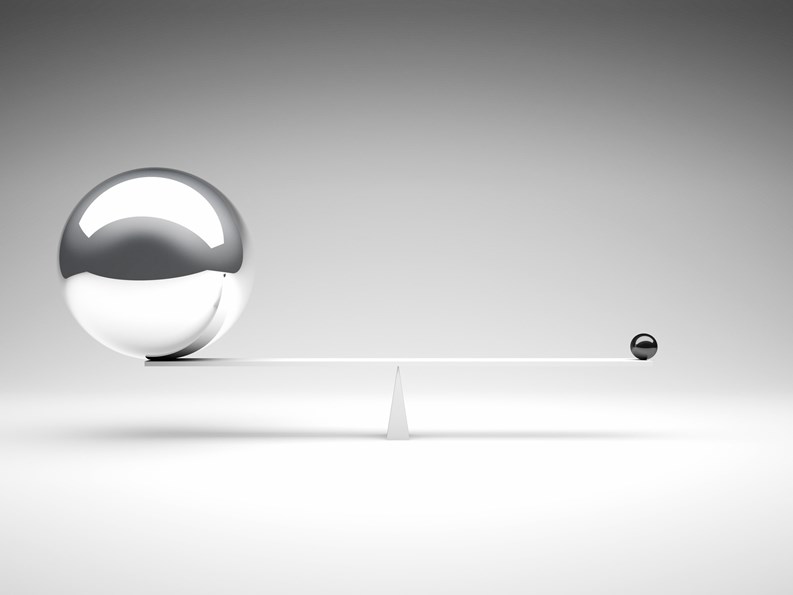

There are management firms that employ literally thousands of professionals in all sorts of specializations, and small firms that employ just a handful of specialists. Size does not dictate approach, however. Some firms are more geared for the efficient and effective execution of basic, daily management tasks—let’s call them generalists—and some take a more tailored approach to provide each client with exactly the experience they are seeking. This dichotomy between generalists and boutique firms has much more to do with a company’s professional approach than with how many people it employs.

“Large firms offer more redundancy in terms of both services and personnel,” says Stephen DiNocco, owner of Affinity Realty and Property Management, based in Boston. “Some clients view this as more availability, in that there’s always someone there to cover their property’s needs. That’s not to say that smaller, more specialized companies can’t do that, too, but in general, larger firms have a larger client base, so it makes sense to offer more services. They may have an accounting arm, an insurance arm, etc. In some markets, they can also offer a slightly better pricing structure.” However, he adds that bigger companies are often more bureaucratic and less flexible. DiNocco says that “clients also may be obligated to engage with the ancillary services the management firm provides. You will get ‘sold’ on their in-house service providers, and may feel you have to use them for those services.”

Though usually smaller in terms of overall staff than big generalist management firms, ‘boutique’ doesn’t mean a company with less ability or experience. “Boutique firm managers will find what the client needs,” says David Goldoff, president of Camelot Realty Group, a New York City-based management firm. “If necessary, boutique firms will go out and hire someone to fill a specific need for a client. A big company might have someone like that already, but access is typically limited.” After all, with a huge portfolio of clients to cover, that in-house person may be handling problems at numerous properties. “So size is not the issue,” says Goldoff. “Expertise is, and that applies to any management firm of any size. It’s really more about access and attention to individual client needs.”

Andrew Marks has seen both sides of this quandary. He is senior vice president of new business and marketing for New York-based management firm Maxwell-Kates and was president of his Manhattan co-op for seven years. (Maxwell-Kates is a subsidiary of Associa Community Management Corp, located in Fairfield, New Jersey.) According to Marks, “Large firms offer the potential for greater resources and bulk purchasing options to be accessed for the benefit of managed property, board, and community. Larger scale also means more stability and staying power in the event of a downturn, as we’ve seen with COVID.

“On the other hand,” he continues, “market pressures and a ‘grow at all costs’ mentality can stretch managers and back-office operations, leading to breakdowns in basic communications and responsiveness, one of the biggest frustrations and most common complaints I’ve seen from my vantage point on both sides of the table.”

For Daniel Wollman, CEO of Gumley Haft, a management company serving about 6,000 units across 75 New York cooperative and condominium buildings, “personal service is the difference. Because we are a smaller company, we are nimble and flexible. We work with less red tape, and have fewer layers to get through in order to get something done, whether managing a renovation or a complicated repair job.” Wollman adds that “our managers communicate daily with superintendents and resident managers of all our buildings, and stay in touch with our board members throughout the week. We are flexible and accessible, in a way that simply cannot happen in larger companies.”

Building Size & the Choice of Management

Should your choice of a management company be based on the size of your association or corporation? Clearly, a 200-unit high rise with a full staff has different needs than a 10-unit walk-up, or an 80-unit townhouse development with acres of landscaping, but your choice should still be made based on the needs of the community as a whole, not exclusively on its size.

DiNocco says, “Communities should pick a management firm with which they can have a good relationship and work as a team. The truth is that many larger firms can’t make a profit from smaller properties, so they simply don’t take them on. Your decision should not be based on large or small, but rather on who offers the services you need, and what type of relationship you want to have. Large companies can provide great service, but smaller firms know more about the property. They know every customer and unit owner. Do you want a close, day-to-day relationship? Or does that not really matter? It’s about what you like. You need a good fit.”

Goldoff points out that one important issue is whether a property employs a staff that needs to be managed. If there are doormen, concierges, handymen, etc., a larger management firm may be more likely to have the ability to handle the human resources component, including personnel and payroll management.

Smaller corporations and associations face different needs. They rarely have a building staff to speak of, and with fewer owners/members, they may have a shallower pool of experience among board members and trustees, and therefore need more support from management in terms of understanding and overseeing the financial health of the community. In this case, the more tailored, individualized approach of a boutique firm specializing in small co-ops and condos might be in order.

Marks observes that “many clients complain of the same pain points over and over: they suffer from a lack of attentiveness, responsiveness, and communications from their managing agent. They can’t rely on their management company to do the basics, and too much falls on the shoulders of board members. This is actually an issue for both clients we’ve interviewed that have one of our larger competitors as their managing agent, as well as [those that use] some of the smaller agents. I was president of my board in my 210-unit co-op for five years, and while we did have a larger corporate entity as our managing agent, until we demanded more accountability and attention, we experienced quite a bit of frustration with lack of communication and attentiveness, as well as a lack of innovation. [They weren’t] as nimble with things like technology, communications, and other necessary innovations.”

Board Confidence & Management Support

One area of particular concern to board members and trustees is their ability to understand and adequately monitor the financial health of their community—and this in turn may influence what management model feels best for their co-op or HOA. In the case of larger management firms, getting a prompt response from a manager on questions about financial issues can sometimes be a problem; in the case of smaller firms, sometimes there is a lack (real or perceived) of individual specialization within the firm about those issues. Boards may question their current management or be uncertain about what to look for in new management. This issue is also a central concern for self-managed co-ops and condos, which don’t have the educational element offered by any management company relationship.

Technology may offer a solution to at least part of this challenge. Parapet, a Brooklyn-based startup, is developing software that integrates with a building’s bank account, analyzes the building’s financial data, and suggests ways for the co-owners to save money and improve the building. The platform is slated to launch in the coming months, initially targeting self-managed condos and co-ops in NYC. “We have talked to many condo and co-op owners across New York, and it’s clear many are struggling to understand their building’s financial situation and take concrete steps to improve it,” says Nate Krinsky, Parapet’s co-founder and CEO. “The software provides transparency into the building’s finances for treasurers, board members, and co-owners alike and makes it easy to complete money-saving tasks such as filing the NYC condo-co-op tax abatement that can save buildings thousands [of dollars] each year. Parapet’s solution will eventually be offered to buildings that employ management companies as well, as a tool to keep the board and residents in tune with the building’s financial trajectory.”

With so much of management and maintenance—physical, financial, and even relational—going virtual, it may be that the size and scope of management firms will level out as more services can be handled remotely or online. For now, the choice of a managing agent rests more on what your community needs rather than what the public image of the potential managing agent is. Size doesn’t matter; approach does. When seeking a managing agent, give thought to what makes your community unique, and what its unique needs are. Then look very carefully at what company can fill those needs and work as your partner.

A J Sidransky is a staff writer/reporter for CooperatorNews, and a published author. He can be reached at alan@yrinc.com.

Comments

Leave a Comment