On October 23, the Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, released the results of its Primary Mortgage Market Survey ® (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaged 6.19%. “Mo…

On October 23, the Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, released the results of its Primary Mortgage Market Survey ® (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaged 6.19%. “Mo…

With inflation still elevated, home prices parked near record highs (despite some recent softening, particularly at the higher end), and insurance costs climbing, more homeowners are running out of cushion—heightening the risk of mortgage d…

With the recent passage of legislation extending key provisions of the Tax Cuts and Jobs Act (TCJA), the debate over who benefits most from the U.S. tax code has once again come into focus. Originally passed in 2017, the TCJA lowered indivi…

A recent item in the Wall Street Journal highlights the potentially dire situation facing residents of Carnegie House, a 324-unit brick co-op building on what’s now called ‘Billionaire’s Row’ in Midtown Manhattan just south of Centr…

Over the past few years, nearly all property owners, including shared interest communities, have seen sharp increases in their insurance premiums. That costs have spiraled and coverage gotten harder to obtain is obvious; the questions are, …

While they all collect fees from residents, it’s important to remember that condos, co-ops, and HOAs are nonprofit entities; those fees go right back into maintaining, repairing, and generally running the building those residents call home.…

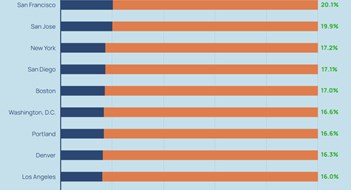

Amid rising mortgage rates and increased financial pressure on American households, one subset of homeowners stands out: those who have fully paid off their homes. A new study from consulting firm Construction Coverage examines mortgage p…

The past few years have seen a dramatic swing from the red-hot market for condos and co-ops nationwide to the more challenging conditions markets around the country are experiencing today. Some of the underlying factors for this shift are b…

As property values continue to outpace inflation, property taxes are taking a bigger bite out of homeowners’ wallets. A new analysis from consulting firm Construction Coverage breaks down property tax rates by state, county, and city to…

In addition to death and taxes, fluctuating interest rates are pretty much a guaranteed fact of life. That reality raises a question for many co-ops with low interest underlying permanent mortgages coming due for refinancing: how to recast …