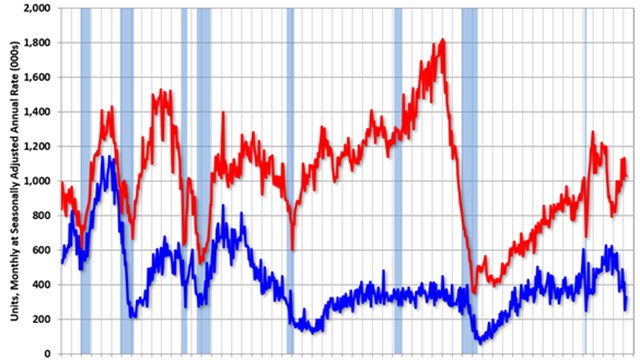

America’s homebuyers have had an extraordinarily difficult few years. Heavy demand and scarce inventory in late 2020 and 2021 led to record growth in prices, while high inflation made it more difficult to save up for a home. As the Federal Reserve has raised interest rates to cool demand in housing and other sectors, the costs to borrow for a mortgage have also increased.

For recent homebuyers and existing owners alike, trends in the real estate market have posed another challenge: property tax increases. Property taxes are usually calculated as a percentage of the assessed value of a property, an estimate that taxing authorities typically update every few years, or when the property is sold. Because home prices have risen so dramatically since 2020, tax assessments are rising as well—which means larger annual property tax bills.

A Mixed Blessing

Higher property taxes can be daunting for homeowners, but they are a boon for state and local governments that rely heavily on property tax revenue. Property taxes totaled nearly $670 billion in 2021, representing more than one-third of all U.S. state and local tax collections. Rising property values should continue to grow that figure in future years. This could also help state and local governments weather the impacts of future economic downturns, which tend to have more immediate negative effects on other revenue sources like income and sales taxes.

While homeowners may be concerned about an increase in their tax bills in light of recent market trends, the overall effective property tax rate nationwide has actually declined since 2014. After reaching a recent peak of 1.157% in 2014, the effective rate—calculated as the aggregate taxes paid divided by the aggregate value of housing units—fell to 1.087% in 2021. Because properties are typically only accessed for tax purposes periodically or when there is a transfer of ownership, changes in the effective property tax rate tend to lag behind changes in residential housing prices.

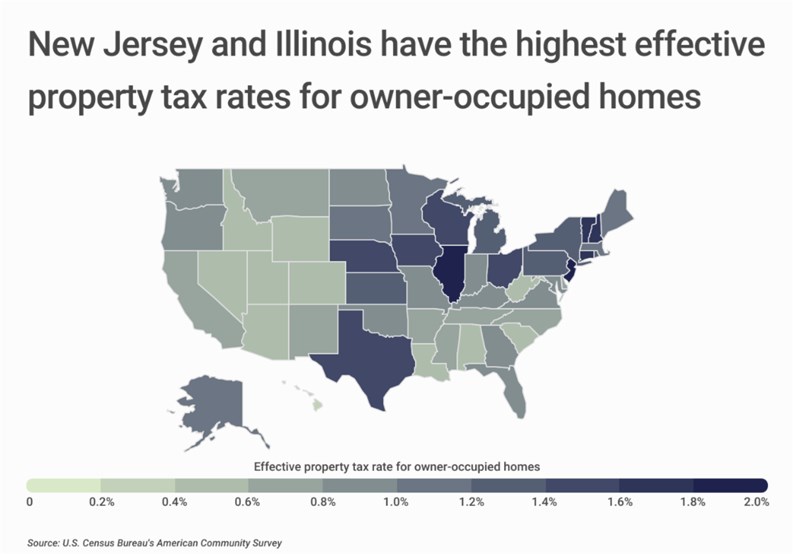

However, taxpayers’ burdens can vary substantially depending on geography. Certain states have put in place laws that limit how much the state or localities can charge in property taxes. One of the most notable examples is California’s Proposition 13, enacted in 1978. Prop 13 caps the property tax rate at 1% (in addition to any local voter-approved indebtedness) and limits when the value of properties can be reassessed for tax purposes. A number of other states have followed suit with similar legislation and ballot initiatives to limit property tax collection in various ways. Even within statewide limits, local governments could also choose to levy taxes at different rates, meaning that comparably valued properties in two localities or taxing districts could have widely different tax bills.

These overlapping state and local policies create a complicated mosaic of property tax regimes across the U.S. At the state level, the Northeast and Midwest tend to have the highest effective property tax rates, led by New Jersey at 2% and Illinois at 1.9%. In contrast, effective rates tend to be much lower in the South and Mountain West regions.

At the metropolitan level, those in Texas and New York headline the list of locations with the highest property taxes. Texas places four major metros in the top 15, while three New York metros are represented—including Rochester, which has the nation’s highest property taxes at a 2.4% effective rate.

Looking at the Numbers

The data used in this analysis is from the U.S. Census Bureau. To determine the locations with the highest property taxes, researchers at Construction Coverage calculated the effective property tax rate for owner-occupied homes by dividing the aggregate real estate taxes paid by the aggregate value of housing units in 2021. In the event of a tie, the location with the greater median property taxes paid for owner-occupied homes was ranked higher.

The analysis found that the NY metro area had an effective property tax rate of 1.4% for owner-occupied homes in 2021, with taxpayers paying a median $9,091 in property taxes. Out of all large U.S. metros, the NY metro has the 12th highest effective property tax rate. Here is a summary of the data for the New York-Newark-Jersey City, NY-NJ-PA metro area:

- Effective property tax rate for owner-occupied homes: 1.4%

- Median property taxes paid for owner-occupied homes: $9,091

- Median owner-occupied home value: $533,700

- Median household income: $84,409

For reference, here are the statistics for the entire United States:

- Effective property tax rate for owner-occupied homes: 1.0%

- Median property taxes paid for owner-occupied homes: $2,795

- Median owner-occupied home value: $281,400

- Median household income: $69,717

For more information, a detailed methodology, and complete results, you can find the original report here.

Leave a Comment