According to a new study by Construction Coverage, a website that provides construction insurance guides, looking at the U.S. locations with the most millennial homebuyers, Millennials—generally regarded as individuals born between 1981 and 1996—have reached the stage in their lives where buying a home is often a top priority.

Recently however, the cost of homeownership has skyrocketed amid high interest rates and scarce inventory, leaving Millennials with a daunting homeownership outlook. In order to cope with these rising prices, buyers in this age bracket are taking out larger home loans with higher loan-to-value ratios than older generations. To identify where millennials are buying homes, researchers for the study ranked metros according to the millennial share of conventional home purchase loans originated in 2022.

Adapting Approaches to a Shifting Landscape

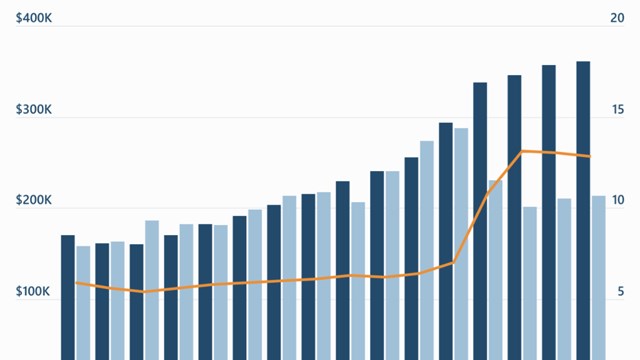

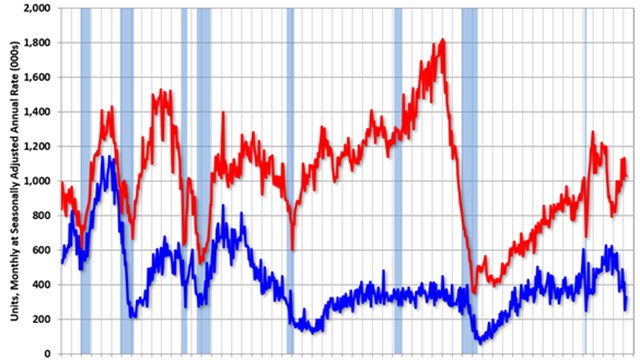

This difficult homebuying landscape has resulted in a dramatic shift in mortgage originations. Prior to the COVID-19 pandemic, U.S. mortgage originations were already on the rise—climbing from $344 billion in Q1 2019 to a 14-year high of nearly $752 billion in Q4 2019. After a brief dip due to pandemic-era stay-at-home orders and social distancing, originated mortgage volume skyrocketed to a new high of over $1.2 trillion in Q2 2021. This abrupt growth is mostly attributed to historically low interest rates, low inventory, and an increased desire for more space amid the pandemic, but these conditions were short-lived. Rapidly rising interest rates combined with other forces, such as return-to-office mandates, have brought mortgage originations down to under $324 billion in Q1 2023, the lowest it has been in nearly nine years.

In order to cope with rising prices, Millennials are taking out larger home loans. In 2022, the median loan amount for mortgages taken out by applicants age 25–34 was $315,000, and $365,000 for applicants age 35–44, higher than any other age group. Similarly, the loan-to-value ratio—or the amount of the mortgage compared to the sale price of the home—was 88% for 25- to 34-year-olds and 80% for 35- to 44-year-olds. Inherently, many Millennials are first-time homebuyers and typically have less existing home equity to apply to new mortgages. Additionally, Millennials are at the stage of their lives where they may be supporting a growing family and require more living space compared to older generations.

Results May Vary…

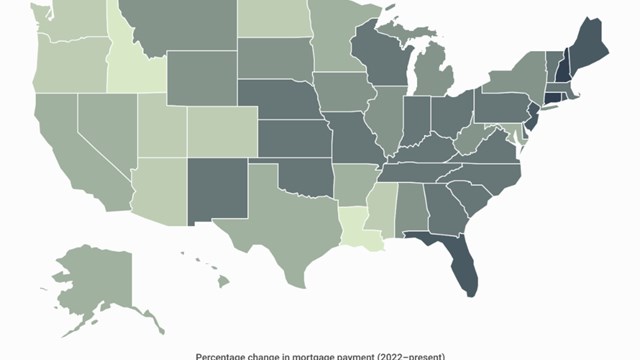

Despite the overall decline in homebuying across the country, Millennials still account for the majority of home purchase loans in 2022 - though their home purchasing varies by location. Millennials in northeastern states account for the largest share of home purchase loans, with Massachusetts (64.5%), New York (63.8%), and New Jersey (63.0%) leading the country. Midwestern states such as Minnesota (62.9%), Illinois (62.6%), and North Dakota (62.4%) also rank among the top 10 states for Millennial homebuying. On the other end of the spectrum, Delaware (41.1%), Florida (45.2%), and South Carolina (46.9%) - which notably have older populations overall - have the lowest share of home purchase loans taken out by Millennials.

To determine the locations where Millennials are buying homes, researchers analyzed the latest data from the Federal Financial Institutions Examination Council. The researchers ranked metropolitan areas according to the Millennial share of conventional home purchase loans originated in 2022. For the purpose of this analysis, Millennials were considered to be those aged 25–44 in the year 2022. In the event of a tie, the location with the greater total number of Millennial home purchase loans was ranked higher.

The analysis found that Millennials took out 64.9% of home purchase loans in NY last year, with a median loan amount of $495,000. Out of all large metros, the NY metro area had the 12th largest millennial share of home purchase loans in 2022. Here is a summary of the data for the New York-Newark-Jersey City, NY-NJ-PA metro area:

- Millennial share of home purchase loans: 64.9%

- Total Millennial home purchase loans: 78,046

- Median loan amount: $495,000

- Median loan-to-value ratio: 79.9%

- Median interest rate: 4.50%

For reference, here are the statistics for the entire United States:

- Millennial share of home purchase loans: 57.8%

- Total millennial home purchase loans: 1,669,539

- Median loan amount: $335,000

- Median loan-to-value ratio: 83.1%

- Median interest rate: 4.99%

For more information, a detailed methodology, and complete results, see Where Are Millennials Buying Homes in the U.S.? on Construction Coverage.

Leave a Comment