Sometimes bad things happen to good buildings. It's just a fact of life. And sometimes, bad things happen to good buildings with an unforeseeable and unavoidable frequency. That is also a fact of life. Usually, when those bad things happen, the building's insurance carrier is there to step in and make things right.

That may not be the case, however, if a building has filed too many claims. Large or small, it does not matter what the particulars of the situation are. If a building has filed more than the average number of claims and is seen as a risk by the insurer, then premiums most certainly will rise and coverage ultimately may be lost.

One way that some buildings avoid doing that is to pay for and take care of smaller problems themselves, shouldering the burden for repairs without ever involving their insurance carriers. While that approach may require a bit of unexpected, out-of-pocket expense for the building, some feel that in the long run, it could help save money by keeping premiums low and avoiding the stress that comes from trying to find a new insurance carrier if they've been labeled risky.

Driving up Costs

As with any economic entity, with insurance premiums there can be a number of causes behind an increase in price. An insurer may decide that the building is actually worth more than they originally thought and can increase the premiums to match that newly assessed worth, says Frank Delucia of the Manhattan office of HUB International Northeast. "Sometimes it takes a while to get to know a building."

Sometimes a premium increase can be the result of external forces over which a building's management has no control. "Insurance companies base a lot of their premiums on what goes on in the stock market," Delucia says. When the market is doing well, the company may be able to invest premiums and garner profit that way. This gives companies more flexibility in establishing their rates, meaning that one carrier may say they will insure a building for $150,000 a year, but because the market is good and profits are stable, the carrier down the street may tell that building that they can insure it for $100,000. That is what is known as a "soft" market. Insurance companies make their money, however, when a hard market takes hold and the flexibility among the various companies disappears. Clients are unable to go to a different carrier to get a significantly lower rate because all of the companies are making their money on premiums and not from other sources.

Coverage also might be expensive and a bit difficult to get based on location. An insurance company "might have a certain capacity" for covering more expensive buildings, Delucia says. They can insure a building on one end of Lexington Avenue but they might not be able to insure one a few blocks down because of the exorbitant cost if more than one of those buildings was lost. "They can't insure a lot of those types of buildings in one area," Delucia says. "They only have a certain capacity."

Most often, though, rates rise because of the number of claims made. "If you make too many claims, rates will go up," says Sarah Jacobusse of Ganfer and Shore, LLP in Manhattan. "Boards often feel it's in the best interest of the building to pay for something rather than risk those higher rates. Often insurance companies won't even look at the size of the claim. They'll just look at the frequency."

Even if it does feel a bit unfair—after all, a building is paying premiums to cover those risks, why should they have to pay for them on top of their annual fees? It's simply how the system works. And sometimes the frequency of claims is seen as a symptom of perhaps a bigger issue. "It tells you a little bit about the insured," Delucia says. "It tells you something's not right if they have a lot of little claims. Everyone's entitled to one or two, but having multiple claims is not a good situation."

Sometimes, however, the size of the claim does matter. Delucia as well as property manager Dan Wollman, who is quoted later in this article, were both involved in the 2006 tragedy when Yankees pitcher Corey Lidle accidentally crashed his plane into Manhattan's Belaire Condominiums. A $10 million claim was made and as a result, the building's premiums rose significantly. In part, the increase came about because the insurance carrier realized the building was worth more than originally thought—a common occurrence as described earlier. The increase also came about as a way to try and recoup the carrier's losses.

The lesson then is that different circumstances can affect premium rates and not all of those circumstances can be controlled by the building or management. There are some things, though, that can be done.

When to Keep Quiet—and When Not To

According to the experts quoted, the solution to the issue of too many claims might be for buildings just to pay for repairs or expenses themselves. "Co-ops do it all the time," Jacobusse says. "Particularly for nominal claims, the co-op might decide it's in their best interest to pay for things themselves."

Delucia agrees. "If it's a large building paying high premiums, they should try to keep their claims in check. They should look at raising their deductibles (to keep costs down). They should be in a position to absorb a little more of the risk, which will benefit them down the road." He adds, "You need insurance for big losses, not little things."

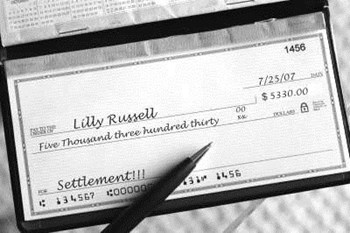

It helps to analyze things from a purely financial standpoint, too. "You have to evaluate based on your deductible and decide if it's prudent or not to file a claim," says Dan Wollman of Gumley-Haft Management. "If my deductible is $5,000 and my claim is $6,000, then there's no reason to make a claim."

There are instances, however, when reporting a claim is an absolute must. That's certainly the case when it comes to liability claims. "People don't always like to tell you about those people who slip and fall and might sue you," Delucia says. "I say you should always tells us. If you don't tell, then the insurance company is going to have an out."

Seemingly insignificant incidents like water damage claims should be examined closely as well. When it comes to water claims, "nowadays because of mold, it's more preferable to notify someone that there's the potential for a claim," says Wollman. There is a notice period in which a building can notify their carrier that there is the possible existence of a claim. "You may feel it's nominal, but then if a month later mold turns up, they're going to deny the claim. So giving notice is important." That's why "nowadays you tend to report more than you would in the past."

It's important, too, to keep the lines of communication open between building management and the insurance broker. "It's better to be open with your broker," Wollman says. "They work with the insurance companies. They know what your situation is. You shouldn't be afraid to ask questions. They know what's happening with the carriers, and they can tell if you're filing too many claims. They can say maybe you should approach an issue this way or that way."

Know the Details

Part of that conversation should involve having the broker walk management and relevant board members through all the details of the insurance policies. "We identify what the client needs and in the beginning, we'll go over the lease contracts, the proposals, the bylaws, the proprietary lease, all of the paperwork to ensure that everyone knows who is responsible for what," says Mike Abreu, also of HUB International Northeast.

It helps also to be clear on what falls under whose purview in terms of claims, says Abreu. A leak reported by a unit owner might only affect his unit or perhaps the unit below. This is a matter for the resident's homeowner's insurance. It is not a building loss, it is a unit loss and therefore, the building should not involve their insurance carrier and risk a possible rate increase.

It's a tricky balance, this insurance game, both for buildings and carriers. There's risk everywhere and the only way to tackle it is to be analytical about it. Building managers need to evaluate costs and examine premiums and make the tough decisions on what costs to swallow and what problems should be shared with their insurers. It's a fine line, too, because saying too little or not reporting a problem could come back to haunt them later. In the end, as with everything, talking to brokers and talking to experts is the safest way to go. And when it comes to insurance, that sense of security is everything.

Liz Lent is a freelance writer, editor, and teacher living in Bloomfield Hills, Michigan.

Leave a Comment