It’s a seller’s market, or so the NYC real estate pundits are telling us. But what does that actually mean? Does it mean it’s easier to sell a home than it would be in a buyer’s market? Are units selling for more money, or more quickly? Does it mean less effort is needed on the part of both sellers and agents to get units into contract and closed on? Not necessarily.

What is a Seller’s Market?

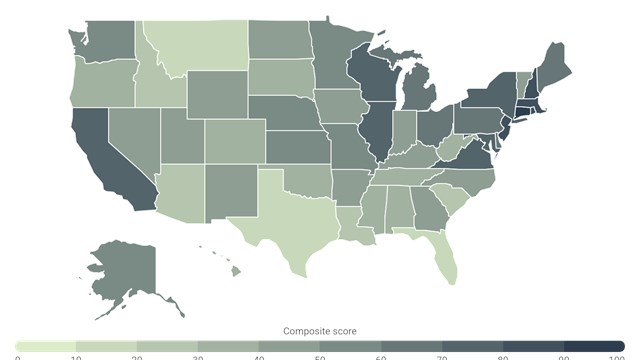

Cynthia Keskinkaya, a sales associate with Douglas Elliman, describes the current climate as follows: “It’s a seller’s market because inventory is very low. We have more contracts signed than apartments coming into the market, so we have more demand than supply.” So in this case, the definition is literal. It’s a function of current inventory.

And it’s also a local thing. “In New York City, a seller's market is block by block, building by building,” says Ariela Heilman, a broker with Brown Harris Stevens. “It’s a seller’s market for an apartment if a building is financially robust, near a subway, has a doorman, has light, and isn't a cut-up.”

Pricing Right

Perhaps most importantly, a seller’s market is not a license to indulge in what many brokers call ‘aspirational pricing,’ demanding some pie-in-the-sky figure for any old unit in any old building. Even with inventory in short supply, pricing must still be realistic and justified, based on a unit’s actual characteristics and merits.

And of course there’s an emotional component to this process; selling one’s home is a big move, and a seller may have an idea of what his or her apartment ‘should’ sell for, but that figure isn’t always strictly rational or data-based. It’s not what you’d like to get for your place - it’s what the market will bear that determines the final figure. Some brokers even suggest the best way to maximize price is to set one’s asking just slightly below market. That is likely to result in multiple offers, and possibly even a bidding war among motivated buyers - which could ultimately result in a price slightly above market.

“Because of limited inventory, when a seller prices well based on precedent past sales,” says Joanna Mayfield Marks, a broker with Brown Harris Stevens in Brooklyn, “competition can be relied upon to drive the price upward.”

Effort Equals Success

Along with prudent, reality-based pricing, there is an array of other methods sellers can employ to maximize the price they get for their unit and minimize the time it spends on the market. Chief among these are staging and painting, which sales agents say are still mandatory in the current market.

“If sellers want to maximize price,” says William Mackay, also with Douglas Elliman, “they still must stage their units. Nothing has changed with respect to that. To get maximum dollars, a seller has to do it right. Some sellers are getting lazy, and may very well be leaving money on the table because they didn’t stage their property properly. They need to do everything they can, including a fresh paint job if necessary, to market the apartment. If the apartment looks shabby, it will sell for less.”

Keskinkaya agrees, pointing out that the expectations of today’s buyers are heavily influenced by their internet experiences. Apartment listings online are clean, tidy, and move-in ready, and that’s what prospective buyers expect when they attend an open house or tour an apartment in person. Failing to meet that standard can result in a lower sales price than expected - even in a low-inventory market.

Words of Caution

Despite the current trajectory, markets can of course change - that’s just their nature, and there are a multitude of factors that can nudge them into a different direction. Industry analysts expect apartment inventory to increase in the spring of 2022. As a word of caution going forward, Marks gives the following advice: “I think the greatest caution for selling in a seller's market is price inflation and appraisal issues. Sellers should price according to precedent - verifiable past sales or in-contract sales - rather than their aspirational or adjusted number for the mean or average market increases. Buyers have so much data at their fingertips - they won’t even darken the door if they feel the price is too high. Don't worry, the price will organically correct upward!”

Comments

Leave a Comment