For the first time in many years, interest rate volatility is a factor in the housing market. The long period of low inflation and low-rate stability that characterized equity growth and a seemingly permanently turbo-charged housing market has come to an end - at least for now. The overall question is what real effect higher rates have had on the co-op and condo markets, and how those effects can be countered.

Rates, Value, & Prices

The value of our property (what it’s worth) and its price (how much it actually costs) are usually in sync, with the one reflecting the other - though that’s not always the case. In some markets - an overheated one, for example - prices may be higher than intrinsic value. Ever-upward bidding in price wars is a good example of this. Alternatively, prices may reflect factors in the market that depress value, such as the so-called ‘covid discounts’ reported during the pandemic, as many buyers got real steals when sellers fled the city. In neither case is the market in equilibrium.

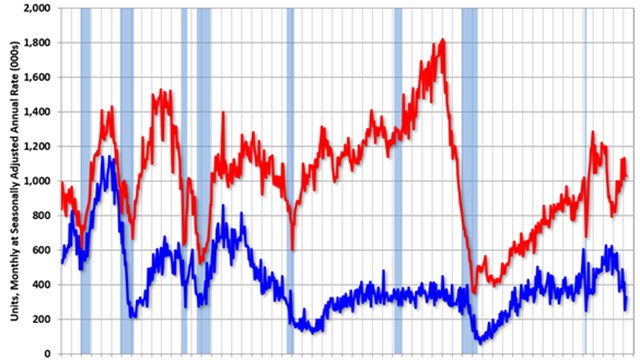

Interest rates - the price we pay to borrow money - can affect prices, as well as long-term values. The more money costs to borrow, the higher monthly carrying costs will be for the buyer. Simply stated, when rates increase, buyers get less for the same monthly cost. The number of qualified buyers available for a specific unit at a specific price also drops, and ultimately, the price of the unit may drop to attract more buyers. While that drop in price is likely, it isn’t necessarily a sure thing.

For example, consider the effect of a three-point increase in interest rates on a $1 million apartment with a $500,000 mortgage. The increase is $15,000 per year, or $1,250 per month. Assuming a rate of return on investment of 5% per year - typical for most investors and investments - that increase in interest cost correlates to a drop in price of $300,000. In other words, the $1 million price of that unit just dropped to $700,000.

But that’s theoretical; nothing like that has happened in the housing market to date, and doesn’t seem to be on the horizon. So let’s talk about the real world.

Lots of Moving Parts

“Rising interest rates affect everyone at every level - there is no way around it,” says Brian McCauley, a mortgage advisor with Fairway Independent Mortgage Corp, a mortgage provider with offices in New York and throughout the United States. “The short term effect is sticker shock, reflecting both how fast increases are happening and how much rising rates increase a buyer’s overall mortgage payment. This in turn will reduce the number of applicants who qualify for a mortgage, and can slow down the demand for housing. Buyers usually feel rising interest rates first. They are affected by the increase in the monthly mortgage right away, and it can deter them from moving forward. Sellers start to feel the effect over a longer period of time, as the demand for home loans and home purchases steadily decline.”

Jonathan Miller, CEO and principal of Miller Samuel Real Estate Appraisal and Consulting in New York City, explains further: “The Fed is expected to continue raising rates. Increasing rates create uncertainty in the market. Buyers can wrap their heads around higher rates, but if it happens every six weeks, it’s a problem.”

It’s too much for the buyer to process and too quickly, Miller continues. One of the problems in today’s market is that with higher rates, it’s clearly less affordable for many. On the other hand, for most buyers today, it doesn’t make sense to fix their monthly costs on a 30-year basis, as few live in the same home for 30 years. Adjustable rate mortgages such as 7/1s, 5/1s, and other hybrids with conversion down the road are still as low as they were before the spike.

Alternatives & Fixes

McCauley offers two possible alternatives to weather the current high interest rate environment, which is expected to continue into 2023, and hopefully will reverse sometime late that year: “Buyers are always focused on getting the lowest mortgage payment possible when buying a home, and that makes sense. But in a market where rates are averaging over 7%, that makes it harder to do. Luckily there are some alternative loan products such as ARMs and also rate buydowns that allow the buyer to obtain a lower interest rate than the traditional bond market is offering.”

As pointed out above, today’s ARMs equate to longer term instruments prior to the jump in rated. Miller also notes that most people don’t stay in their home for 30 years, and therefore a 30-year fixed rate product is not necessary for their financial planning.

“In my opinion,” McCauley continues, “every buyer should consider buying down their interest rate. This is a solution wherein the buyer can secure an interest rate up to 3% lower than the current market is offering. It can be expensive, but the key in a market like this is to negotiate into the purchase contract that the seller pay the cost to buy down the rate. This strategy is becoming more and more popular as rates continue to rise - it’s usually only available to buyers during a cooling market, and can work to the buyers favor - where nine months ago, it wouldn’t have even been considered.”

It appears at this juncture that higher interest rates are a fixture of the home sales market, at least for the near-term. While prices in New York have not yet seen more than a negligible downward move, buyers, sellers, and brokers need to consider alternatives to keep the market moving.

Leave a Comment