A proposed Republican New York State Senate bill calls for an increase in the number of condo projects from the outer boroughs as part of a revised 421a tax abatement program to spur affordable housing--a move that earlier prompted concern from New York City Mayor Bill de Blasio, The Real Deal reported Wednesday.

According to the article, the bill could allow as many as 80 units outside of Manhattan to be eligible for the tax exemptions, which would represent an increase of 45 additional units from Gov. Andrew Cuomo's proposal from last January.

The story referenced State Senators Simcha Felder (D-17th Dist., Brooklyn) and Marty Golden (R-22nd Dist., Brooklyn) as the legislators who had previously advocated for more larger condos from the outer boroughs to have the tax breaks. Neither the two senators, as well as representatives for the governor and the Real Estate Board of New York (REBNY), commented to The Real Deal about the new proposed Senate bill

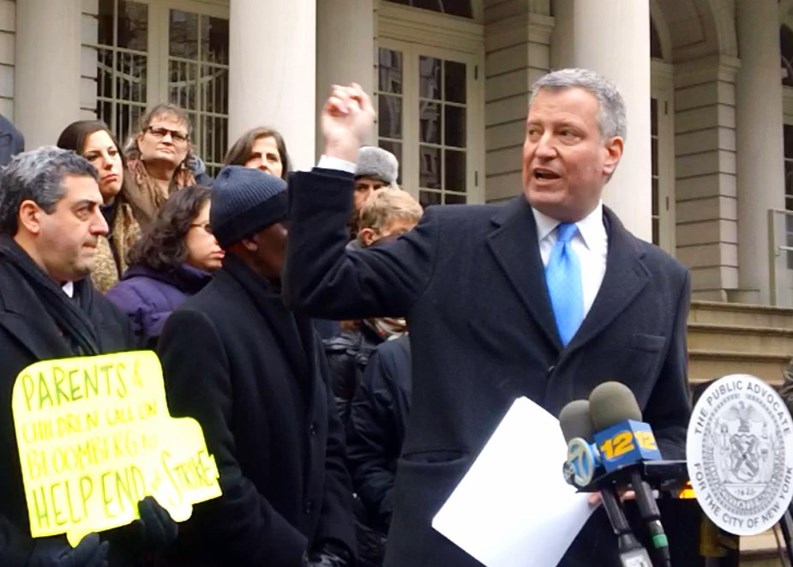

Last January, amid reported talk in Albany about adding more condos to the revised 421a program, de Blasio earlier expressed his concern, saying that such a move would “creep back into the direction of the old and broken system.”

A spokesperson for de Blasio provided a statement to The Real Deal in response the latest Senate proposal: “This is an affordable housing program, not a giveaway for condos. We can't accept the Senate's proposal. There is no justifying more and more costs piled on New York City taxpayers, without a single affordable apartment to show for it.”

Two months ago Cuomo announced the revived 421a program, now called Affordable New York, following an agreement that was reached with the real estate community and labor unions. As he said at the time: “This agreement will help fulfill the real need for more affordable housing in New York City while recognizing the work of the employees who build them. It will expand housing opportunities for low-income individuals by lowering income eligibility requirements and extend affordability for projects created with 421-a for an additional five years. This is a major step forward in our efforts to provide affordable housing in New York City and ensuring benefits and fair wages are paid to hardworking men and women. I’m urging the Legislature to pass the Affordable New York bill.” (As of this moment, that bill has not seen passage).

The governor touted the program during a radio interview with John Catsimatidis, saying that Affordable New York will create about 2,500 units per year of affordable housing. “It’s actually, in my opinion, a better program than the old 421-a," Cuomo said then. "This has increased the length of affordability 40 years, and it’s actually made it more affordable for people to qualify.”

As previously reported by The Cooperator, the Affordable New York would grant developers tax incentives for up to 35 years, an increase from 25 years under the previous 421a program. In addition, construction workers who are involved in these projects under the program would make $60 per hour in Manhattan, and $45 in Brooklyn and Queens. Affordable New York would expand housing opportunities for low-income individuals by lowering eligibility requirements.

Meanwhile, the city's Independent Budget Office last January suggested that under the old version of the 421a program, which has since expired, New York City had wasted up to $2.8 billion between 2005 and 2015, based on a study that examined condos, Reuters reported. What was originally intended to encourage affordable housing development actually benefited to condo owners under this form of tax relief. According to the article, “Manhattan condo owners paid only 53 to 61 cents on average for every dollar received in tax savings.”

Additional reporting by A.J. Sidransky.

David Chiu is an associate editor at The Cooperator.

Leave a Comment