In May, in a decision that has confused - and alarmed - some New York co-op shareholders, the New York Court of Appeals ruled that co-op boards had the right to apply the business judgment rule to vote so-called "objectionable tenants" out of their buildings for ongoing, objectionable behavior.

As reported in The Cooperator's June 2003 edition, the court's ruling provides that co-op boards can terminate the leases of troublesome or recalcitrant tenants without having to go to court to prove that they are "˜nuisance tenants' under the definition of such law.

This newly recognized application of the business judgment rule - which according to the 1990 ruling in Levandusky vs. One Fifth Avenue gave co-op boards wide discretion in handling their own affairs - emerged following long-running litigation between an Upper West Side co-op and one shareholder by the name of David Pullman. The 40 West 67th Street vs. Pullman decision allowed boards to extend the reach of the business judgment rule to include taking action against individual shareholders.

The Pullman case involved everything from alleged adultery to informal charges of libel and slander, and thousands of dollars-worth of attorney fees and court costs on both sides. The court eventually found in favor of the co-op corporation, and Pullman was forced out of the building and has since moved into a condominium.

With the Pullman case setting quite a precedent, some boards around the city greeted the decision with joy, certain that now they can finally do something about that eccentric shareholder who keeps unnerving his neighbors or the amateur aspiring chef who constantly fumigates the hallway (and the adjacent apartments) with the noxious vapors from her exotic cooking.

Conversely, some shareholders embroiled in conflict with their boards are now terrified, convinced that the Pullman decision means that it's only a matter of time before their board convenes to vote them out onto the street. There's no doubt that the Pullman verdict is a big deal - but who's right, and who's overreacting?

According to Al Pennisi, president of the Federation of New York Housing Cooperatives and Condominiums (FNYHC) and a senior partner with the Queens-based law firm of Pennisi Daniels & Norelli, LLP, "We've had a lot of concerned inquiries from [board presidents] thinking that the Pullman decision equals carte blanche; that if they have some small problem with a tenant shareholder, [their board] can terminate them. That's not the case - the conduct must be objectionable under the building's governing documents."

And, says Greg Carlson, the executive director of the Federation, "I get calls from shareholders where the board has been entrenched for many, many years and has not had an annual meeting or given out financial statements - they're their own little kingdom, and there's where you have the propensity for problems with abuse of power [post-Pullman]. That's something we have to be wary of."

And that seems to be the key to the biggest impact the Pullman decision has had thus far: boards have not been ejecting obnoxious tenants in record numbers - rather, they have been consulting their legal counsel to determine whether or not they have that right, and taking steps to add appropriate language to their governing documents giving them the power to vote out problem shareholders if it's not there already.

According to attorneys closely involved with sorting out the aftermath of the Pullman decision, the majority of buildings already have language in their governing documents to cover the ejection of disruptive, objectionable residents. If a board feels that a shareholder is "engag[ing] in repeated actions inimical to cooperative living, and objectionable to the corporation and its stockholders that make his continued tenancy undesirable," as the court's decision so succinctly states, and the building's lease contains provisions for the termination of that tenant's lease, the board may move forward and evict the tenant by a simple vote. As long as the board is acting in good faith, and the tenant is truly objectionable, it could be an open-and-shut case.

On the other hand, if a board shows, according to one attorney, "the slightest indication of any bad faith, arbitrariness, favoritism, discrimination, or malice," in terminating a resident's shares, then the situation may get considerably more messy, should the shareholder decide to file suit for discrimination or bad faith.

According to Pennisi, "The issue is really that once you've made the decision [to terminate a lease], the court cannot go behind that decision, even if the person in the black robe thinks that board's decision [is] improvident, or is not a good decision in [his or her] opinion - they cannot test that opinion, and they can't test that objectionable conduct. That subjective decision is made by the board - the court can only test the good faith, and whether the decision follows the corporate documents - that's critical."

According to David Baron, president of Bell Apartment Owners Corporation in Bay Terrace, Queens, "I think Pullman is good for any co-op, because it upholds the board's judgment - the court is not going to substitute their judgment for ours if we act in good faith in furtherance of our co-op. The Pullman case is a powerful tool for boards, period."

According to Adam Leitman Bailey, a Manhattan-based attorney closely involved in the aftermath of the Pullman verdict, "You no longer have to prove to a judge that you were right or wrong in trying to evict the person for the conduct that's alleged; all you need is for your corporate documents - your proprietary lease - to allow you to evict the shareholder via a building vote, as in the Pullman case, or by a vote of directors, [if their conduct is deemed objectionable.]"

"A lot of people are misconstruing the decision," adds Pennisi, "thinking that since Pullman was the decision of shareholders in a co-op, the Business Corporation Law (BCL) can only be applied or upheld by the courts when a tenant-shareholders vote - as they did in Pullman. Levandusky (the previous precedent-setting case) was a board vote, as opposed to a shareholder vote, so it can be a board or tenant-shareholder decision, depending on what the building's governing documents have to say about it."

And that's what it all boils down to, say the experts: governing documents. Says Pennisi, "That's what we've been telling all boards and shareholders who ask us: since May, they've been calling up, saying, "We're going to do A, B, and C,' and I ask them, "˜What do your governing documents say - do you have the right within your proprietary lease to do this?' And they say, "˜Oh, we're going to amend that,' and I tell them that they'd better go to their shareholders to amend it."

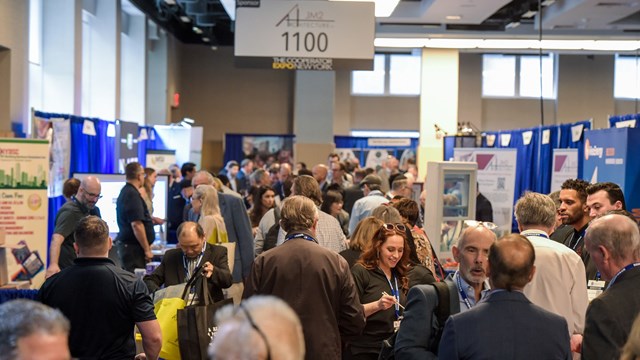

At a roundtable discussion on the various issues facing New York's co-op and condo community hosted by The Cooperator this past summer, Jordi Reyes-Montblanc, president of both the Housing Development Fund Corporation Council (HDFC) and a co-op development in the Hamilton Heights section of Upper Manhattan expressed some dismay at the spin the Pullman case was getting in the media. "Because of the articles appearing in the news," said Reyes-Montblanc, "Pullman has been misinterpreted. When the articles came out, I would get calls from boards asking, "˜Can we do this? Or this?' And we tell them, "˜cool down!'"

Legal experts are quick to stress that the one thing Pullman doesn't give boards is the power to unilaterally create rules and bylaws that weren't spelled out before. "Boards are now taking the position that they can amend their own rules to give them power to do something that the proprietary lease doesn't give them the power to do," says Pennisi, "and such an amendment would be stricken [in court], even with Pullman, because you can't just do that - you have to go to your shareholders if you're going to amend the lease that they've signed."

Unless your building's governing documents already provide your board with the power to simply vote out objectionable shareholders - as is the case for the board at Bell Apartment Owners Corporation - you've got some campaigning to do before the board can start making changes.

And the power to make those changes may be worth the effort, according to Baron, who pointed out some of the benefits of empowering a board to vote to evict without shareholder quorum. "We're a 300-unit, five-building co-op on a large parcel of land, so not everybody knows everybody. It's hard to get two-thirds of the shareholders to come to a meeting, much less to vote against their neighbors. Our board has the right to vote to terminate a shareholder's lease. It's something that our governing documents provide for us."

Others aren't quite as ready to embrace the idea of unilateral eviction powers becoming common currency. According to Reyes-Montblanc, "What I like about Pullman was that it was based on a two-thirds vote of those shareholders. I believe in the power of the board, but not just that power - getting the shareholders to participate in the decision was important. If a joint decision of the board is backed by the shareholders, there shouldn't be any doubt that the person is obnoxious, and they're not wanted in the buildings."

If you're a shareholder who takes a certain amount of pride in needling your board every chance you get, or have ongoing feuds with more than a few of your neighbors, this might be a good time to reassess your attitude.

"Anybody who's been a nuisance for years is in danger," says Bailey. "If you've cost the board a lot of time and money, made people angry, and made a lot of enemies, [the board will] say it's good faith that [they're] getting rid of you, because you're not living in our community the way [they] want you to."

But, says Pennisi, it's not necessarily curtains for you if you've been a habitual nuisance to your board or an irritant to your neighbors. "The courts will look to see that there was good faith, and that the board acted honestly within the corporate purpose. So if Al Pennisi is a pain in the neck because he complains that the floors are dirty, or the sidewalk's a mess, or the garbage isn't kept up properly, [your board] can't just decide that "˜Al Pennisi is a pain in the neck, so we're going to get rid of the guy - we'll vote him out.' Those cases would not be upheld. The courts will prevent that because it's a discriminatory act - it's not in the interest of the corporation. If you're making a complaint for the good of the corporation, why should you be kicked out?"

And what about Pullman's impact on the co-op market, and prospective buyers' attitude toward cooperative living? "Some people are saying, "˜Gee, maybe I should buy a condo and not a co-op, since if I become too proactive, they'll just single me out and kick me out of the cooperative,' says Pennisi. "If anybody asks me, though, I really can't believe that's going to be the case - that the courts will just follow Pullman blindly and let people get kicked out for no good reason. [The Pullman] case was extreme. That's the kind of case that would have a decision upheld against the shareholder - not the average Susie and John who may be complaining because they should complain. And even if they are unfounded, in most cases, boards aren't going to go after them in the first place."

The appellate decision in Pullman vs. 40 West 67th Street is only six months old, so the true measure of its impact hasn't yet been felt. That will come with the emergence of more case law applying the decision, and how it's interpreted by the courts. For now, says Pennisi, "Even some attorneys are confused about the ramifications of this decision. What we've learned is that Pullman is so important because we're talking about substituting the decision of the board with the decision of the court in instances of objectionable conduct, so that's one big issue. Another is that a lot of people are under the misconception that Pullman "¦ only stands for cases involving objectionable conduct - a lot of people and attorneys don't realize that you can apply it to any decision of the board, and where it gets gray is the issue of due process; you must give notice [of action] to the tenant-shareholder. Whether they choose to show up is their own decision."

And finally, says Pennisi, "The BCL has been around since the turn of the last century, so it's not new, but it's newly-applied to co-ops and condos. I don't think we're going to see a big rash of these cases. It really takes a case like Pullman to make an example."

While the furor of the Pullman case has abated somewhat, time will tell what legal impact the decision will have years down the road. Until then, though, if shareholders act in a reasonable manner, there should be no need for worry.

Leave a Comment