It’s difficult to plan a budget for your building—and, more importantly, to stick to it—if problems arise that your board/management team haven’t anticipated. Maintenance issues and structural crises aren’t just inconvenient surprises; if you haven’t planned adequately, they can decimate your community’s bank account.

Capital reserve studies are one way to prevent surprises from popping up. These assessments are performed by engineers and/or architects who go over your building with a fine-toothed comb: making note of the age, condition, and possible trouble spots of the various components of your physical plant. Data gathered from this study goes into a report that is then submitted to the board and management, who can then use the information to better plan for their building’s financial long-term.

Planning for a Reserve Study

Once your board and management team decides that a capital reserve study is the thing to do, you’ll need to figure out how often you should have one performed. According to experts, you should consider having one done about every five years.

“Conditions to the physical plant can change more—or less—than originally anticipated and costs can also change dramatically,” points out Victor Rich, a veteran CPA with Manhattan-based RSM McGladrey.

According to Rich, costs for a study like this will vary depending on certain factors, including the size and age of the property, demand and competition for similar services in the area, and the quality and depth of study desired by the board.

Another expert, Richard B. Montanye, CPA, and partner with the Manhattan-based accounting firm of Marin & Montanye, LLP, estimates that studies should cost between $5,000 and $20,000, “depending on the size and complexity of your building.”

Normally completed by building engineers and architects, a capital reserve study is occasionally done by a CPA, or by general contractors knowledgeable in real estate, although Rich cautions against using the latter for such consulting work.

“I would be reluctant to use a general contractor, since he or she likely would be the least independent. They [might] be looking to do at least a portion of any current or near future work required,” he warns. “Unless he was told beforehand that he was being hired only as a consultant and would not be selected to perform any of the work required.”

The Process

Once you hire the professional who will perform your capital reserve study, how long can you expect the assessment process to take?

Anywhere from several weeks to up to six months, according to those in the know.

The timeframe can depend on various factors. First of all, what is the size of the study? How many areas of your building or complex are to be covered in depth? How complex are the maintenance issues your community faces? Which firm is handling the study, and how large is it? Also, what personal and professional demands are working on your specific contact at the firm?

The best course of action is to allow more time for the study, just in case issues arise that you hadn’t counted on. That way, if any red flags pop up when the engineer or architect is doing their work, you’ll have a cushion of time on your side to best decide how to set up your maintenance calendar and finances.

When performing the reserve study, the firm will look at various aspects of your property. Key areas of scrutiny will include the age and general physical condition of property, its location (i.e., is it in a flood zone, drought/fire prone area, hurricane area, tornado area, etc.?) and the quality of the property (e.g., luxury vs. middle- or lower-income).

“[Other] key areas to look out for are the projected cost of replacement or repair at the future time when the work will have to be done and, as a practical matter, the ability of the property owners (and willingness of the board) to pay for different quality levels of work to be performed,” says Rich.

During this process, it’s entirely possible the professional conducting the assessment will hit a red flag.

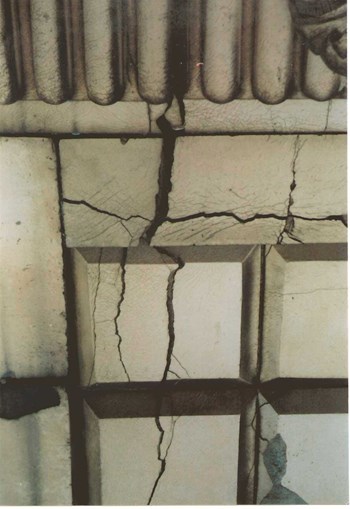

“Deferred maintenance is normally the big issue,” explains Montanye, whose firm represents over 300 housing co-ops and condos. “If ongoing maintenance is performed on a building, there may be no red flags. However, since many buildings do not want to incur the expense of ongoing maintenance, many surprises come up during these studies.”

Montanye offers the example of a building that may need significant pointing or waterproofing work. If this work had been deferred for years and building leaks hadn’t been taken care of, many times during the pointing work, the contractor will discover that steel has rusted and needs to be replaced at a very high cost.

Using the Results

Once the assessment itself is finished, how can boards and managers make practical use of the information they contain?

First of all, the study’s findings can be very helpful in preparing the capital budget and, to a lesser extent, the operating budget, according to Jay Novet of Budget Saving Strategics in Great Neck who works as a consultant to co-ops and condos.

Also, boards and managers can use the information to prioritize projects and create a timeline for accomplishing these tasks.

“Inevitably, projects take longer than anticipated,” says Montanye. “But the study provides a good working model for decision making purposes funding the associated costs.”

Once the board hears the results of the study and roughs a skeleton plan of what replacements or repairs are to be done, they should share this information with all the co-op and condo owners.

“The reserve study results should be sent to all of the owners to read and digest, followed by an open board meeting to discuss the reserve study issues and the general sentiment of the owners,” says Rich.

This would be followed by a request for written comments and suggestions by owners, which, in turn, is followed by a specific recommendation by the board to the owners. A vote could follow to confirm the decision of the board.

“The plan for replacements and/or major repairs should include timing, financing and scheduling,” adds Rich. “Planning for the necessary larger projects to be done well in advance will usually result in lower costs and the opportunity to engage the better, more in-demand firms to do the work.”

During this planning process, the question presents itself: how far in advance should the average co-op or condo board actively plan for their building financially?

“Your accountant has depreciation schedules detailing life expectancies for every part of your property for accounting purposes,” advises Novet. “That benchmark is ideal to work with. For example, roofs will have one depreciable life expectancy, while boilers, their own. No guidelines exist to say depreciable lives of items must necessarily be the same.”

Montanye recommends that this type of planning should be an ongoing process and that a board should look ahead ten years “to determine projects that need to be done, plus wish list items that they might have.”

Rich agrees that planning should occur at regular intervals.

“The financial plan should go out at least ten years, with major review and revision after each five years,” he says. “You should have more modest summary reviews and possible revision of any more obvious specific item or items each year or at least every other year.”

Benefits of Capital Reserve Studies

The benefits of having a reserve study done on your building can go beyond simply having a clear-cut plan for maintenance and repairs. When it comes to resale, for instance, unit owners might find it’s easier to move their properties since the buyer might feel more confident about what he/she is purchasing.

“The sale will probably take place more quickly and possibly at a higher price than might otherwise have been the case,” says Rich. “Also, the current owners will be in a better position to financially plan accordingly over the mid-term and long-term, without having to worry about unexpected emergency assessments—which may become constant for an older property, especially one which has not been maintained on an ongoing basis.”

“Also, a good reserve study whose resulting projects are being adequately financed in advance may result in reduced insurance premiums,” he adds.

The main benefit, however, is simply that you and your unit owners can be confident that you’re doing everything possible to plan for the future.

“At least with a plan and funding in place,” says Montanye, “work can commence without being in panic mode to find sources of money.

Domini Hedderman is a freelance writer and a frequent contributor toThe Cooperator.

Comments

Leave a Comment