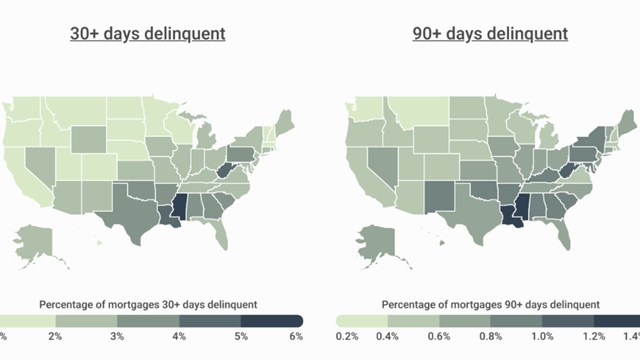

Compared to previous generations, Millennials (those born between 1981 and 1996, give or take) have a conspicuously low rate of homeownership. While the ranks of millennial homeowners have expanded slightly over time, the numbers still fall far below those of preceding generations. According to the latest data from the U.S. Census Bureau, the homeownership rate among that age cohort stands at just 39.5%, while the national homeownership rate is 63.9%. Research from the Urban Institute suggests that a variety of overlapping factors contribute to the disparity, including crushing student loan debt, lack of affordable housing, delaying marriage (often because of the aforementioned debt) and geographic preferences.

While millennials helped boost urban growth after the Great Recession, in recent years, that trend has reversed, with millennials leaving big, expensive cities for smaller, more affordable markets - or not even moving to cities in the first place. The ongoing pandemic will most likely add fuel to this trend; after all, what’s the point of paying top dollar to live in a city where you can’t actually enjoy many of the social and cultural activities that justify the high cost of living there? And this says nothing of the job loss, reduced hours, and general economic and financial uncertainty that so many now face thanks to the coronavirus.

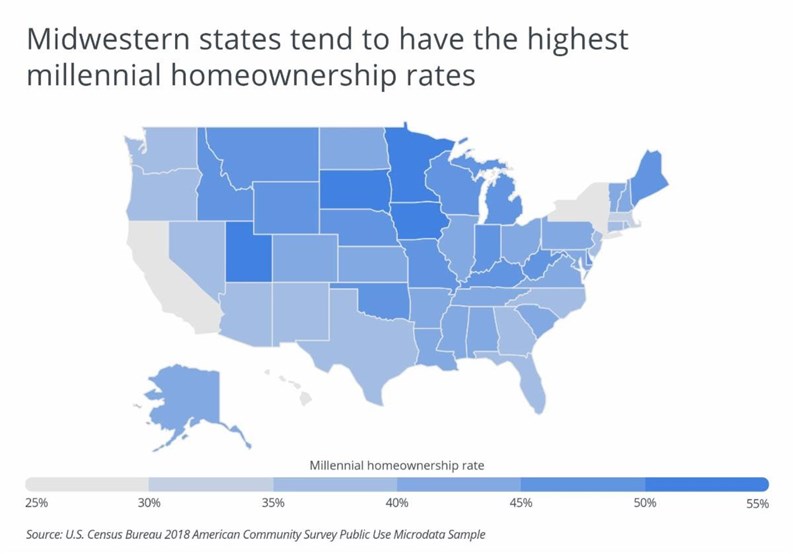

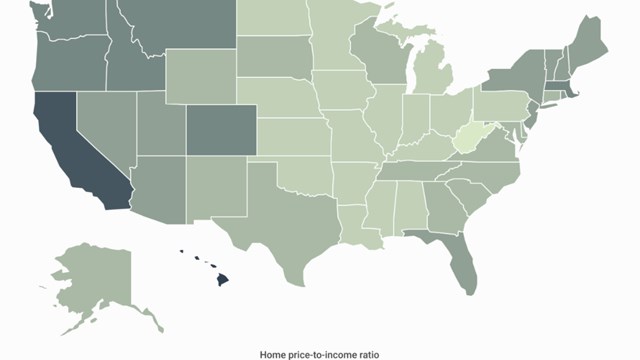

Millennials may trail behind overall when their homeownership numbers are compared with older Americans, but the gap does depend somewhat on the market in question. For example, the Midwest - notably Iowa and South Dakota, which have the highest rates of millennial homeownership in the country, with 53.7 and 51.5 percent, respectively - has a much higher percentage of ownership in that age demographic than New York, California, or Hawaii, whose rates are all below 30 percent.

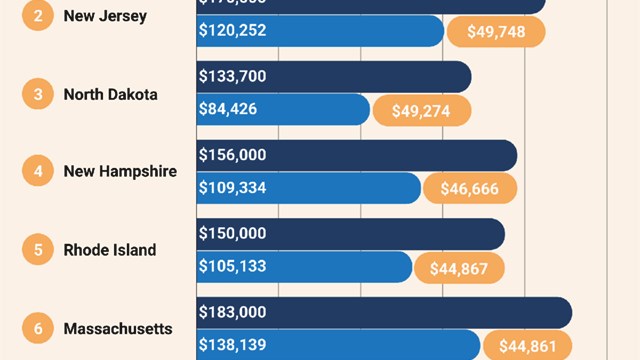

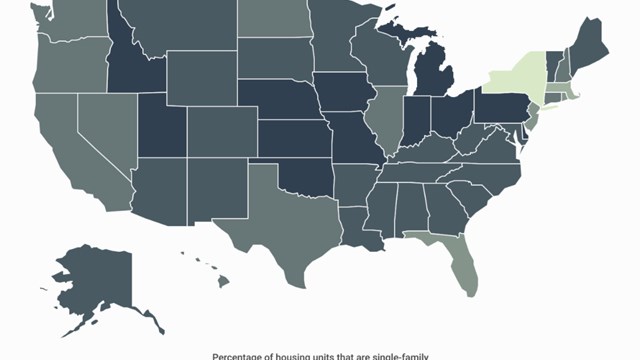

To find out where millennials are buying homes, researchers at home services marketplace Porch analyzed the latest data from the U.S. Census Bureau, the Bureau of Economic Analysis, and real estate search site Zillow to rank the homeownership rate among millennials across metropolitan markets nationwide. To improve relevance, only metro areas with populations of at least 100,000 were included in the analysis. In the event of a tie, the metro with the larger number of millennial homeowners was ranked higher. Researchers also calculated the median home price, the typical monthly mortgage payment, median earnings for millennials working full-time, and the cost of living.

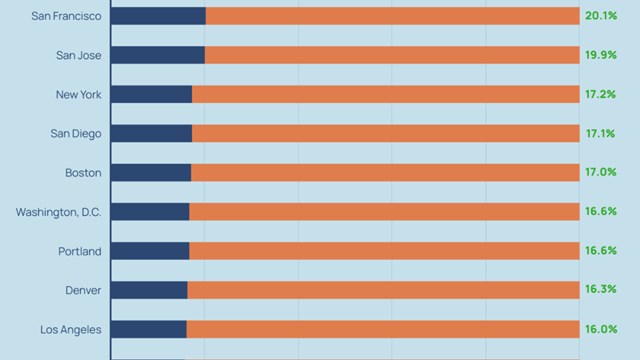

The analysis found that in New York, only 26.6% of millennials own their homes. Among all large metropolitan areas (those with more than 1 million residents), New York has the 5th lowest millennial homeownership rate in the U.S. Here is a summary of the data for the New York-Newark-Jersey City, NY-NJ-PA metro:

Millennial homeownership rate: 26.6%

Median home price: $489,137

Monthly mortgage payment: $1,735

Median yearly earnings for millennials working full-time: $51,000

Cost of living: 24% above the national average

For reference, here are the statistics for the entire United States:

Millennial homeownership rate: 39.5%

Median home price: $251,598

Monthly mortgage payment: $893

Median yearly earnings for millennials working full-time: $40,000

Cost of living (compared to national average): N/A

Leave a Comment