As the economic disruptions from the COVID-19 pandemic grind on, Congress has provided additional relief for small businesses to help them hang on until nationwide vaccination efforts are able to turn the tide of the crisis. The good news for co-ops is that it appears they are now eligible to seek assistance in the face of falling revenues through the Paycheck Protection Program (PPP).

The PPP was designed and launched in the spring of 2020 to provide gap financing to employers who have experienced a severe drop in revenue due to mandatory restrictions and shutdowns imposed on business activities due to the pandemic. It’s easy to understand how a restaurant might suffer such a devastating decline in revenue - but what about a co-op building?

Revenue Decline

Cooperative corporations are not-for-profit organizations. Basically, co-op shareholders pay in their proportional maintenance fee every month to cover the expenses associated with running their building. These fees are calculated and set to do exactly that, with some reserve cushion - not to make a profit. So what then could cause a co-op to experience a reduction in revenue that leads to it being unable to pay bills like staff salaries, underlying mortgage payments, and real estate taxes?

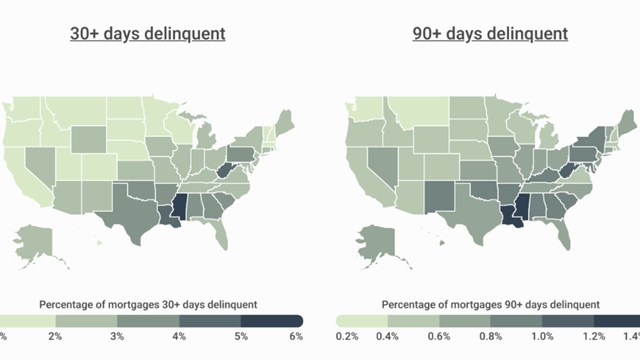

From a practical point of view there are two likely possibilities: arrearages from shareholders being unable to make their monthly maintenance payments, and even more likely, arrearages from commercial tenants who can no longer pay their rents.

Co-ops with commercial tenants calculate their annual budget to include those tenants’ rent; that income offsets the amount necessary to meet obligations that’s then proportionally divided between shareholders in the form of their monthly maintenance charges. If that commercial income suddenly disappears, what choices do board and management have to meet their community’s financial obligations?

The Payroll Protection Program

Avi Zanjirian and Stephen Beer of the Manhattan-based accounting firm of Czarnowski & Beer explain the federal PPP program as follows: “In order to qualify for [PPP loan] forgiveness, at least 60% of the funds must be used for payroll - including health insurance premiums and employee benefits, such as matching 401K contributions. These funds are usually sufficient to cover the maximum 24-week period to spend the funds and qualify for forgiveness of the loan. If not needed for payroll, the remainder of the funds - up to 40% of the loan - may be used to cover utilities, mortgage or rent, or lease payments. The loan is only eligible for forgiveness if used properly.”

As far as how this new incarnation of the program relates to cooperatives, Beer and Zanjirian explain: “While we continue to await guidance from the Small Business Administration (SBA) on several key items - including if cooperatives, which are now eligible entities - have to prove a 25% reduction in their gross revenues to apply for this round, even though it will be their first draw.” In the meantime, they suggest potentially eligible co-op corporations use the steps below to gather information and be prepared as potential PPP clients, both as first and second draw applicants:

Steps to Take Now

- Co-op managing agents should gather a list of any client buildings wishing to apply for funds. That list should include a contact name, phone, and email for each building’s board. Boards applying for loans should be prepared to show quarter-over-quarter or year-over-year financial reports demonstrating that the building or community has experienced a 25% reduction of its gross revenues. Audited reports will be requested upon loan forgiveness if available.

- Managers and/or boards should confirm that the co-op’s bylaws and lender (if the corporation has an underlying mortgage), allows for them to apply for a PPP Loan

- Borrowers must confirm that a board member is willing to apply and attest to all language in the application (click here to view the full document: https://home.treasury.gov/system/files/136/PPP-Borrower-Application-Form.pdf). Even if the co-op isn’t required to prove a 25% revenue loss, the board must still make a good faith certification that: (a) the uncertainty of the current economic conditions makes the loan necessary to support the ongoing operations of the co-op, (b) that funds will be used to retain workers and maintain payroll or make mortgage payments, lease payments and utility payments, and (c) that the co-op does not have an application pending for and/or has not received a duplicative loan.

- The board and/or manager should calculate 2.5 months average payroll for the co-op. The formula for calculating how much funding your building is complex, so it’s highly advisable to work with your accountant on this calculation, as well as on determining any other benefits that may be included. 940 & 941forms are preferred reports but if you have a PEO or third-party payroll provider who cannot provide these for you by building, you can use other payroll reports that show this information.

- If you’re an existing PPP borrower seeking a so-called ‘Second Draw’ from the funding pool, you’ll need to confirm that you can meet the 25% reduction in gross revenues quarter-over-quarter (Q2, Q3, Q4) from 2019 to 2020 or now "year over year" if that's easier. Interim financial reports are acceptable.

- No matter what - whether your building is a first-time PPP applicant or coming back for another drink from the relief funding well, it’s vitally important that you involve qualified financial professionals in the process to avoid mistakes that could delay funding or result in penalties months or even years from now.

A Legal Note

Under normal circumstances, individual board members - who are nearly always volunteers to begin with - are covered by their board’s directors and officers (D&O) insurance policy, which protects them from personal liability resulting from decisions made in good faith, but which result in damage of some kind. That may not be the case with PPP loans, cautions Mark Hakim, an attorney specializing in co-op law with Schwartz Sladkus Reich Greenberg Atlas, based in New York City. “Any board member who signs the PPP application could be subjected to criminal penalties for any false or misleading information,” he says. They would likely not be protected under their Directors & Officers insurance policy for any false or misleading statement. This is not surprising; indeed, it’s similar to the protocol involved when a board member signs certifications on behalf of their co-op in a mortgage refinancing for example. “There’s a lot of money being put out there,” says Hakim, “and the government is just trying to make sure it’s being used for the correct purposes.”

The Cooperator will be following up on this story as more guidance and information specific to co-op communities emerges.

Leave a Comment