Another new bill - known as INT 914 - with the intention of increasing the pace and administrative transparency of co-op share transfers is currently before the New York City Council.

What’s In It

INT 914 would require the boards of co-op buildings containing 10 or more units whose transfers are not subject to approval by a state or city agency under private housing finance laws to maintain a standardized application and list of required application documents and materials for all prospective purchasers, explains Hal Coopersmith, a partner with the law firm Coopersmith & Coopersmith, located in Manhattan. The board or managing agent, he continues, must provide the standardized application, list of required materials, and instructions for where and how to submit them to any prospective purchaser and seller promptly upon request. The board must provide written acknowledgement of receipt within 10 days of receiving those materials, and then has 45 days to inform the purchaser whether its approval of the purchase is granted unconditionally, conditionally, or is denied. According to Coopersmith, that 45-day window may be extended for up to 14 additional days at any time with the consent of the purchaser.

If a prospective purchaser’s application is missing materials, or in some other way fails to comply with the board’s stated requirements, the board must send the purchaser a written notice specifying what is missing, and/or why the application is not in compliance; the 45-day time window can be tolled up to three times, until the corporation receives additional materials from the purchaser.

A purchaser may treat a failure to comply with this law as a denial - and they, or the seller, may commence a court action to determine whether a board is in violation. The court shall assess statutory damages of $1,000 for each failure to provide the corporation’s standardized application or acknowledge receipt of the materials; $5,000 for failure to maintain a standardized application; and $10,000 for failure to provide notice of approval or rejection of the purchase within 45 days.

Further, says Coopersmith, the court cannot require a corporation to consent to a sale, but may award compensatory damages and attorney’s fees to the prospective purchaser, and may order appropriate equitable relief. The New York City Commission on Human Rights may also initiate investigations in connection with a violation, and may award additional civil penalties ranging from $1,000 to $25,000.

Benefits All Round?

What the intricate legal language means “in the real world,” says Coopersmith, “[is that] boards will be required to approve or deny a purchaser within 45 days of receipt of an application, with only one 14-day extension.”

When it comes to implementing INT 915, “Technology is a big driver of the feasibility this bill,” notes Coopersmith. “Previously, the standard for board packages were extensive paper copies of personal and financial information distributed to individual board members. Technology has enabled digital board packages to be uploaded and distributed securely. This allows for review in a timely manner from anywhere in the world, not just at a physical, in-person board meeting. With the widespread adoption of Zoom and other technology in the pandemic, there are fewer obstacles to a timely and rapid board decision.”

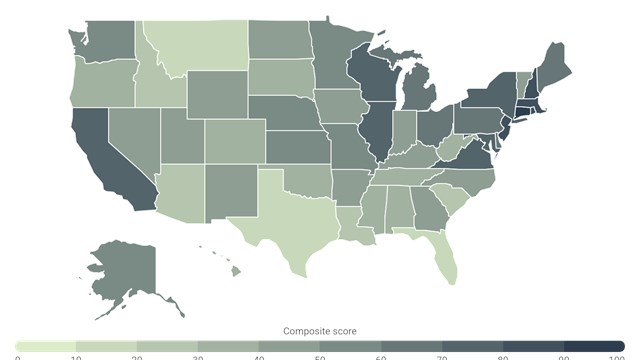

And while boards have been subject to a lot of new legislation and administrative pressure in recent years on everything from mortgage funding to energy conservation requirements, INT 915 can actually be seen as a net good for all sides of the transaction. “A quicker decision would benefit both purchasers and sellers in a transaction,” Coopersmith says. “They would have certainty as to the status of their transaction. A long wait time for approval of a purchaser's application could affect an interest rate lock. Sellers also want to have certainty in the transaction. There was a recent poll that showed a high level of favorability towards the proposed law, especially among people at high income levels.”

3 Comments

Leave a Comment